Best Accounting Program For Mac Users

What Is Enterprise Accounting and Financials?

- Best Small Business Accounting Software For Mac Users

- Accounting Software For Mac

- Paint Program For Mac

Most small business operators will be familiar with accounting software aimed at that segment, the most popular of which might arguably be Intuit QuickBooks. While this is great software, it can have trouble when faced with requirements typically handled by larger organizations, including a large user base, increased security requirements, reconciliation across multiple geographies, and especially integration with other enterprise-oriented operational packages, such as asset management or large-scale inventory tracking.

For the purposes of this review roundup, rather than relegate these reviews to midsize businesses only, we'll instead use the increasingly more popular segment description 'SME software'—small to midsize enterprise accounting. And the metric we'll use to determine if a particular accounting system falls into this category is its ability to handle complex business functions.

More than Just Bookkeeping

The reason for using this particular approach is simple: Over the past decade or so, business has changed dramatically. With the internet fostering global sales, inventories in multiple locations and countries, and a bewildering mélange of currencies and taxes, even a company with just a few employees can require the sort of financial system complexity once reserved solely for multibillion dollar multinationals. Those multinationals could afford to spend hundreds of thousands of dollars on IT and financial system acquisition, implementation, and support on an ongoing basis, but most SMEs cannot.

The goal of SME software is to present a good portion of this capability at a price and usability a modest-sized business can afford. In this review roundup, we test 10 SME accounting systems that, for the most part, exist in the cloud, either as managed services or hosted systems. Many of the financial systems we reviewed are actually parts of larger suites, including additional modules covering a wide variety of functionality such as customer relationship management (CRM), business intelligence (BI), project management, data mining, financial reporting, complex budgeting and forecasting, and any number of other areas. For that reason, we had to limit what we looked at and, for now, we stuck with general ledger accounting. Look for us to examine some of these other modules in more detail in an upcoming roundup covering SME enterprise resource planning (ERP) apps.

Personal finance software can cost as little as nothing or as much as $130 – much depends on what you want your software to do and if you prefer using an app, an online portal or a program downloaded to your computer.

- Best Overall Small Business Accounting Software: QuickBooks Online QuickBooks Online is great for businesses of all shapes and sizes, especially for businesses that are quickly growing and expanding (or expect to do so in the future).

- Best Billing and Invoicing Software: Billing and invoicing software is designed to help users avoid financial errors and keep the accounting numbers precise. You can use it for tasks such as automating recurring jobs to save time, to get financial calendar notifications to avoid fines, etc.

SME Customizability

Because of their modular approach to software delivery, the SME accounting systems we look at here for the most part allow customers to build their own financial systems based on what their operations require. While we examine baseline general ledger capability, these systems often also offer vertical market versions tailored for specific kinds of businesses, such as nonprofit entities, manufacturing companies, distribution businesses, or real estate management, for example. Generally, these are add-on modules that install over the baseline accounting software.

For example, production, warehousing, and distribution businesses all have very different inventory needs, and this becomes even more complex when the business houses inventory of different kinds in multiple locations or countries. One of the areas we examined, but did not test, was a vendor's ability to meet these various inventory complexities, including bill of materials (BOM) processing, kitting (inventorying subcomponents of a finished product), and supply chain management.

Other characteristics of higher-level accounting systems include the ability to handle multiple companies and divisions, frequently with intercompany or interdivisional transactions; multicurrency capability, enhanced security, and features such as self-service payroll where the employee can directly access his or her information and make limited changes such as increasing or decreasing the number of dependents.

Cloud-Scale Accounting

Another important characteristic of SME software is scalability. This is more of an issue with in-house systems than it is with cloud-based accounting, because scalability is mainly limited by the infrastructure upon which the system is running. In your data center that infrastructure limit can be quickly reached, thereby limiting your scale. In the cloud, you've got as much infrastructure as you feel like paying for at any given time.

In terms of SME accounting, scalability can be viewed as the ability to add simultaneous users. As the company grows, and as the financial system grows beyond bookkeeping into other areas of financial and managerial utility, the need to grow its users base quickly and easily is critically important. However, because these are high-end systems, especially when you get into in-house financial and ERP systems, scaling up for more users can mean substantially increased licensing costs, higher maintenance fees, and the need for higher-end hardware (if you're running the system in-house rather than as a managed cloud service).

Another limiting factor in SME accounting scalability is the underlying database. Most entry-level accounting apps use a proprietary database or a third-party offering with an inexpensive licensing fee. Either model, however, can limit the number of users. On the other hand, true enterprise financial systems are likely to use expensive databases, such as IBM DB2, Oracle, or SAP, any of which can dramatically drive up licensing, implementation, and maintenance costs. In between these two extremes, you'll find apps using Microsoft SQL Server (though this one is quickly approaching high-end database territory in terms of both feature and licensing complexity), MySQL, or PostgreSQL. While the accounting staff probably doesn't need to know what the underlying database of their accounting app is, it's definitely something your IT department needs to know and factor into their long-range planning—and that's regardless of whether the overall system is housed on-site or in the cloud.

Fortunately, your IT department won't have to work alone when it comes to implementing these SME accounting systems. That's because, for the most part, SME accounting systems are not offered for customer installation but rather only through value added resellers (VARs), most of which will make installation part of the package. None of the apps we tested are off-the-shelf retail boxed products, whether they're eventually housed on-site or in the cloud. However, while these services can drive up costs, they can also be highly valuable.

Depending on the complexity of your business, installation, feature selection, onboarding, and even ongoing support, can all save significant time, at both the implementation stage and if anything ever goes wrong. Good planning and coordination between your staff, the reseller, and your accountant are difficult must-haves but can pay big dividends down the line.

Evaluating SME Accounting

In our reviews, we tested using a fully functional testing account provided by the vendors, except when a cloud-based or hosted account wasn't available. In these few instances, we installed the in-house version with the help of the vendor or a designated reseller. Many of the accounting apps we tested include mobile access. With these apps, we tested available remote operations by using an iPad Air, a Lenovo Android tablet, and a Microsoft Surface 3, in addition to a desktop PC (which was our primary test platform).

When testing these systems yourself, remember that, while SME accounting systems are extremely powerful apps, the one you choose should fit as closely as possible to the way your business runs. That means you need to put in some real work to understand the workflows in your business—not just various accounting practices but also how your inventory is truly managed, for example, or how billing occurs for different kinds of customers. Meet with key business process owners and walk through all of the major workflows of your business before deciding on an SME accounting platform. You need to be aware of where data is generated, what it's used for, and how it might interact with other apps beyond the accounting system. The better you understand these nuances and the closer you can match the app's capabilities to what you need, the more successful your implementation will be.

Featured Enterprise Accounting Software Reviews:

Oracle NetSuite OneWorld Review

MSRP: $999.00Pros: Solid customer relationship management features. Broad enterprise resource planning features apply to wide variety of businesses. Excellent drilldown capabilities from several system views. Simple reporting. Custom process workflows. Easily navigable, hierarchical dashboards.

Cons: Confusing help system. Difficult to configuring system for specific roles. Broad but complex feature set.

Bottom Line: Oracle NetSuite OneWorld is written for the cloud, focusing on ease of use and modularity. It is a solid financials platform that can be easily expanded to meet other business needs simply by buying additional functionality through the cloud.

Read ReviewAcumatica Review

MSRP: $1000.00Pros: On-premises or cloud deployment. Robust amount of costing methods. Works on many databases. Solid reporting. Non-user-based pricing accommodates growing companies. Browser-based app makes it easy to use mobile devices. Navigation is easy.

Cons: Estimating licensing costs can be difficult. Standard report filters may need customizing. Reliance on third-party add-ons needed if implementing ERP for companies outside the manufacturing/distribution vertical. Unusual pricing structure.

Bottom Line: Acumatica's intuitive design, enterprise scalability, and flexible pricing model help make Acumatica an excellent choice for enterprise resource planning, general ledger accounting, and inventory management.

Read ReviewAccountMate Review

MSRP: $3125.00Pros: Many report export options. Great transaction drilldown. Extensive online training and help functionality. Solid audit trail report capability

Cons: . No HR or POS modules for ERP implementations. Limited graphics and charting. Task shortcuts need to be configured. No true dashboards. No process flowchart navigation.

Bottom Line: AccountMate is a solid entry in small to midsize business (SMB) financials, inventory management, and enterprise resource planning (ERP). Though it's missing some sophisticated features that other products have, it's still very usable and configurable.

Read ReviewCougar Mountain Denali Summit Review

MSRP: $275.00Pros: Easy navigation. Two of the three bundles include Crystal Reports. Available as a single purchase or per-month payments. Can be purchased directly or through a reseller channel. Fund Accounting edition available.

Cons: Crystal Reports costs $495 extra, even for the most basic bundle. Report filters and data entry screens are not particularly intuitive. Not much charting or graphics capability within most modules.

Bottom Line: Cougar Mountain Denali Summit is aimed squarely at midsized businesses and it sports a wide variety of expansion modules. Its design can be a little lackluster in places, but for most businesses it provides a serviceable financial platform.

Read ReviewOpen Systems Traverse Review

MSRP: $175.00Pros: Deep dashboard drilldown. Full suite of ERP creation modules. Good documentation and Help screens. Available in-house or hosted. Includes Working Trial Balance report. Screen, forms, and reports customization. Easy hosted mobile access.

Cons: No Flowchart/Process navigation. Setting up data entry and reports is somewhat complex.

Bottom Line: While Open Systems Traverse is one of the oldest players in the space, it actually shows its age in areas like UI design. Still it's a solidly capable mid-tier financial platform that's well worth a look.

Read ReviewSAP Business One Professional Review

MSRP: $82.00Pros: Extensive customization available. Underlying SAP HANA database allows for complex business analytics. Microsoft SQL Server also available. Includes Crystal Reports for custom reporting. Can handle multiple currencies. Benefits administration module. Excellent documentation.

Cons: Initial configuration and installation usually requires partner or expensive Value Added Reseller (VAR). Extensive customization necessary. Only supports Mozilla Firefox browser; testing failed. Ancillary system applications such as HR have pared-down feature sets.

Bottom Line: SAP Business One Professional has good features and flexibility overall, but is designed as an 'old school' enterprise resource planning (ERP) platform. It may be too complex for many users especially small to midsize businesses (SMBs).

Read ReviewSage 300 Review

MSRP: $75.00Pros: Mobile access from multiple operating systems using Google Chrome. CRM available in the 300 product line. Easily changeable dashboard widgets. Customizable, ribbon-based navigation menus.

Cons: Payroll and inventory unavailable as 300 components. No hard timetable for adding modules. No flowchart/process navigation. Limited dashboard widgets on screen. Missing drill-down or navigation capability.

Bottom Line: Sage 300 is a mid-range accounting and enterprise resource planning (ERP) software solution that is easy to use. But its functionality and expansion modules are limited, and it lags slightly behind the competition in drill-down and customization features.

Read ReviewQuickBooks Desktop Enterprise Review

MSRP: $900.00Pros: Easy-to-navigate process menus. Familiar user interface (UI) for current QuickBooks users. Huge user community. Simple forms and report customization. Large number of standard and contributed reports. Excellent import capabilities. Excellent integration with Sales and Purchasing.

Cons: Offers only Average Costing if acquired without Advanced Inventory feature. No Economic Order Capabilities. Basic Low Inventory warnings. Scalable only up to 30 users. Proprietary database. No true central documentation. Mobile access only with an add-on service.

Bottom Line: QuickBooks Desktop Enterprise is a good next step for companies that have gotten to large for Intuit's more small business-focused cloud-based versions. However, there are some scalability and back-end integration issues you'll want to consider before making the move.

Read ReviewMicrosoft Dynamics GP Review

MSRP: $5000.00Pros: Exceptional functionality. Numerous optional components can bring it up to true ERP capability. Base software (Starter Pack) is very well-provisioned. Available on-premises or as a managed cloud service. Large variety of available mobile applications. Huge number of customizable reports.

Cons: Outdated user interface (UI) isn't user-friendly. Workflow isn't intuitive. Will probably require extensive (and expensive) configuration and customization from Microsoft partners/resellers. Modular approach can result in an expensive system if many subsidiary journals are required.

Bottom Line: Microsoft Dynamics GP puts functionality rather than user-friendliness at the top of its feature list.

Read Review

Keep Your Business Running With an Online Accounting Service

According the US Bureau of Labor Statistics, about 20 percent of small businesses fail before they complete their second year. Among the many potential culprits for this widespread demise is the lack of effective money management and bookkeeping. Small business accounting software can do a lot to prevent your business from falling into this trap, keeping you on the right side of that grim statistic.

Financial bookkeeping is complicated and time-consuming. Business owners find it challenging enough to cover the basics—paying the bills and tracking incoming revenue—let alone answer critical questions such as these: Are we profitable? Why or why not? Can we make required tax payments? Should we invest in new equipment? Do we need to explore financing? Will we hit our budget numbers? Where can we cut expenses?

A good small business accounting website can answer these questions in seconds, based on the input you provide. Once you've populated a site with information about your financial accounts, your customers and vendors, and the products or services you sell, you'll be able to use that data to create transactions. These feed into reports, which can provide critical insight. Instant search tools and customizable reports help you track down the smallest details and see overviews of how your business is performing. Android apps and iOS apps for the services give you access to your finances anywhere that you have wireless connectivity.

QuickBooks Online's advanced implementation of technology, its skillful blend of features, its customizability, excellent mobile apps, and user experience have made it our Editors' Choice again this year. We're not crazy about the recent price increase, but Intuit services are often heavily discounted.

Setting Up Bookkeeping

Depending on how long your business has been operating, getting started with an accounting website can take anywhere from five minutes to several hours after signing up for an account. Accounting services charge monthly subscription fees and usually offer free trial periods. The more you need the site to do, the longer your setup tasks will take (and the higher the monthly payment).

First, you'll need to supply your contact details. If you want your logo to appear on sales and purchase forms, you can upload a file containing it. Some accounting service sites ask whether you plan to use specific features like purchase orders and inventory tracking, so they can turn them on or off. You may also be asked when your fiscal year starts, for example, and whether you use account numbers.

Do you want access to the transactions you have stored in online financial accounts (checking, credit cards, and so on)? Enter the user name and password you use to log on, and the accounting site will import recent transactions (usually 90 days' worth) and add them to an online register. Would you like to let customers pay with credit cards and bank withdrawals? You'll need to sign up with a payment processor like Stripe or PayPal (extra charges will apply).

Your People and Your Stuff

One of the really great things about using an accounting website is that it reduces repetitive data entry. Once you fill in the blanks to create a customer record, for example, you'll never have to look up that ZIP code again. When you need to use a customer in a transaction, it'll appear in a list. The same goes for vendors, items or services, and employees. No more card files or messy spreadsheets.

Once you've completed a customer record and started creating invoices, sending statements, and recording billable expenses, all of those actions will appear in a history within the record itself. Some sites, like Zoho Books, display a map of the individual or company's location and let you create your own fields so you can track additional information that's important to you (customer since, birthday, and other things like that).

If you have employees that you've been paying using another method, payroll setup can take some time and effort, since you'll have to enter payroll history information. Even when you're starting fresh with employee compensation, there's a lot of ground to cover. The site needs very precise details about things like your payroll tax requirements, benefits provided, and pay cycles. Many accounting solutions offer personal assistance with this task, and they all make it clear exactly what needs to be done before you run your first payroll. (Note, however, that some of the products here don't offer payroll capability.)

It is possible to do minimal setup and then jump into creating invoices, paying bills, and accepting payments. All of the services included here let you add customers, vendors, and products as you're in the process of completing transactions (you'll need to do so anyway as you grow and add to your contact and inventory databases). You just have to decide whether you want to spend the time up front building your records or take time out when you're in the middle of sales or purchase forms.

Most small business accounting sites offer the option to import existing lists in formats like CSV and XLS. They provide mapping tools to make sure everything comes in correctly. This procedure works better in some products than others.

Moving Money and Products

Accountants like to use phrases like accounts receivable and accounts payable to describe the primary elements of accounting: recording and tracking income and expenses, or sales and purchases. Small business solutions are designed to appeal to people who don't use the same kind of language as accounting professionals, avoiding such terminology.

The services let you easily create any transaction that a small business is likely to need. The most common of these are invoices and bills, and all the services we reviewed support them. Applications like Xero and Zoho Books go further, allowing you to produce more-advanced forms, such as purchase orders, sales receipts, credit notes, and statements. They provide templates for these online forms that resemble their paper counterparts. All you have to do is fill in the blanks and select from lists of customers and items.

Once you've completed an invoice, for example, you have several options. You can save it as a draft or a final version and either print it or email it. If you do the latter and you've established a relationship with a payment processor, your invoice can contain a stub explaining how the customer can return payment via credit card or bank withdrawal. You can create a PDF version of the invoice, copy it, record a payment on it, or set it up to recur on a regular schedule.

All forms on these sites work similarly. These solutions also pay special attention to your company's expenses—not bills that you enter and pay, but other purchases you make. This is an area of your finances that can easily get out of control if it's not monitored. So accounting websites monitor them, divide them into expense types, and compare them with your income using totals and colorful charts.

Email marketing program for mac. Windows will run concurrently as your other Mac programs.

If you're traveling and have numerous related expenses on the road, for example, you can take pictures of receipts with your smartphone. Some sites just attach these receipts to a manually entered expense form. Others, like QuickBooks Online, actually 'read' the receipts and transfer some of their data (date, vendor, amount) to an expense form.

As we mentioned earlier, one of your setup tasks involves creating records that contain information about the products and services you sell so you can use them in transactions. These vary in complexity, so you need to understand the differences before you go with one site or another. Some, like Kashoo, simply allow you to maintain descriptive records. Others, like QuickBooks Online, go further. They ask how many of each product you have in inventory when you create a record and at what point you should be alerted to reorder. Then they actually track inventory levels, which provides insight on selling patterns and keeps you from running low.

Banking and Reports

While much of your daily accounting work probably involves paying bills, sending invoices, and recording payments, you also need to keep a close eye on your bank and credit card activity. If you've connected your financial accounts to your accounting service, this is easy to accomplish. For one thing, their balances will often appear on the site's dashboard, or home page. You'll also be able to view each account's online register, which contains transactions that have cleared your bank and been imported into your accounting solution (along with those you've entered manually).

You can do a lot with these transactions once they appear in a register. For one thing, they should be categorized (office expense, payroll taxes, travel and meal costs are some examples) so you know where your money is coming from and where it's going. Every service guesses at how at least some transactions might be categorized; you can change these if they're incorrect and add your own. Conscientious categorization will result in more accurate reports and income tax returns.

You can also match related transactions, such as an invoice that was entered in the system and a corresponding payment that came through. Again, some sites make educated guesses here. You can split transactions that should be assigned to multiple categories, make notes, and reconcile your accounts with your bank and credit card statements.

Read It in a Report

Reports are your reward for keeping up with your daily work and completing it correctly. Every accounting website comes with templates for numerous types of insightful output. You select one, customize it using the filter and display options provided, and let the site pour your own company data into it. It only takes a few seconds to generate a report after you've defined it.

There are really two types of reports. The bulk of them are the type that any small businessperson could customize, generate, and understand. They tell you who owes you money, which of your products and services are selling well, whether you're making money, which expenses and services haven't yet been billed, which customers are buying the most, how much you owe in sales tax, and more.

There are other reports, though, that aren't so easy to view and understand. These are considered standard financial reports, and they're the kind of documents you'll need if you ever want to get a loan from a bank or attract investors. They have names like Balance Sheet, Statement of Cash Flows, Trial Balance, and Profit & Loss. Accounting websites can generate them, but you really need an accounting professional to analyze them and tell you in concrete terms what they mean for you company.

How Accounting Sites Work

Accounting probably doesn't make the list of things you like to do as a business owner. It can be complicated, and it needs to be done correctly. So, the makers of online accounting solutions have worked hard to present this discipline as simply and, well, pleasantly as possible. Some—including QuickBooks Online, Zoho Books, and ZipBooks—have been more successful at this than others.

If you've ever used a productivity application online, you shouldn't have any trouble understanding these services' structure. They all divide their content into logical modules by providing toolbars and other navigation guides. Sales tasks are grouped together, as are purchase, inventory, reporting, and payroll activities. There's always a Settings link that takes you to screens where you can specify preferences for the entire site; these include your setup chores and settings you may need to modify at times, such as restricting additional users to specific areas.

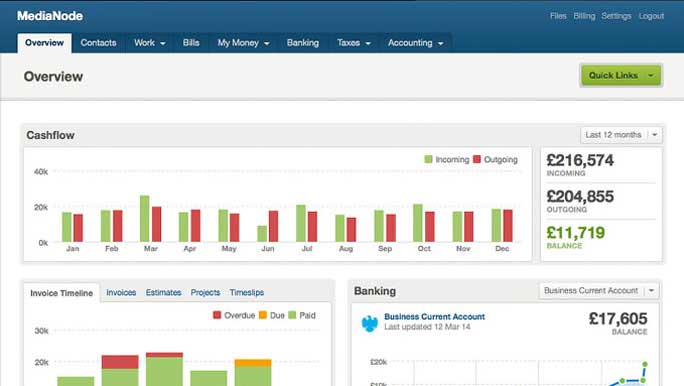

A site's dashboard homepage provides a real-time overview of the financial information you need to see frequently, including charts comparing income and expenses, account balances, and invoices and bills that need immediate attention. There are often links to areas of the site where you can take action.

You use standard web conventions to navigate around each site and enter data. Along the way, you'll encounter lots of buttons and arrows, drop-down lists and menus. Color is sometimes used to signify related information, while graphics and fonts are well chosen to make the sites as aesthetically pleasing as possible.

Accounting Software for Simpler Businesses

If you're a sole proprietor or freelancer, you probably don't need all the features offered by full-featured small business accounting websites. You might want to track your online bank and credit card accounts, record income and expenses, maybe send invoices, and track time worked (if you're service-based). Maybe you need to track mileage. You might need help estimating your quarterly income tax obligation, and you certainly want mobile access to your financial data.

Best Small Business Accounting Software For Mac Users

There are numerous sites that can do a combination of these things. They're easy to use, inexpensive (totally free in the case of Wave), and they overwhelm you with functionality you don't need.

Our Editors' Choice this year in this category goes to FreshBooks. This beautifully designed website started life as a simple online invoicing application, and it's since added more tools, including basic time- and project-tracking, expense management, estimate and proposal creation, and reports.

FreshBooks lacks some features that others offer, though. It doesn't help with quarterly estimated taxes, while GoDaddy Bookkeeping and QuickBooks Self-Employed do. It doesn't have its own integrated payroll-processing application like Wave does (though it integrates with payroll Editors' Choice Gusto and dozens of other related web services), and it's not a true double-entry accounting like Billy is. Wave also lacks QuickBooks Self-Employed's real-time mileage tracker and it doesn't automate as many processes as Less Accounting.

Note that while we did review Less Accounging, it didn't make the cutoff for this roundup of the top ten services. The same is true of Sage Business Cloud Accounting and ZipBooks.

The Accounting Software Your Business Needs

Whether you need one of these entry-level financial management websites or your business is complex enough that you need to start with one of the small business accounting options, we think you'll find that this year's batch of solutions offers enough variety that you can find the right fit for your business.

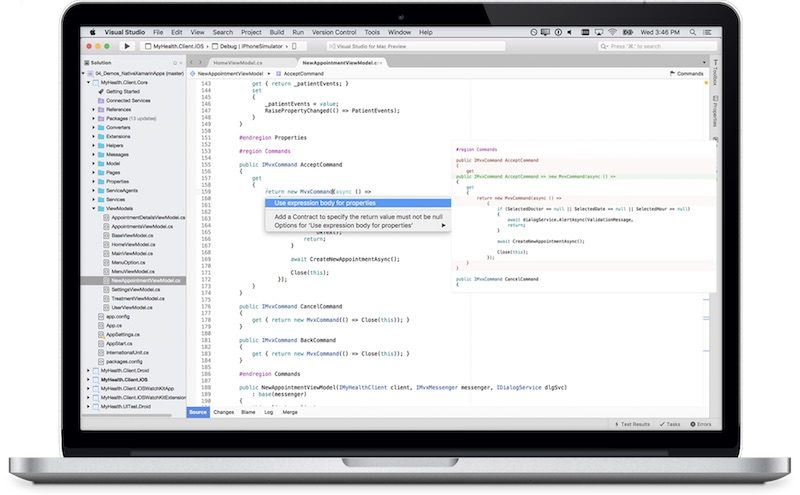

Mar 07, 2017 Now we have two Visual Studio versions (Visual Studio for Mac, Visual Studio Code) that can directly install on the Mac (macOS), refer to your description, it looks like you installed the Visual Studio for Mac, it is a developer environment optimized for building mobile and cloud apps with Xamarin and.NET.  With support for ASP.NET Core in Visual Studio for Mac, you are empowered to create beautiful, modern web applications. Craft the front-end with the same web editor experience you know and love from Visual Studio and Windows and publish to the cloud directly from the IDE.

With support for ASP.NET Core in Visual Studio for Mac, you are empowered to create beautiful, modern web applications. Craft the front-end with the same web editor experience you know and love from Visual Studio and Windows and publish to the cloud directly from the IDE.

Accounting Software For Mac

While you're thinking about your money, you might also like to consider our reviews of online payroll services and tax software.

Paint Program For Mac

Best Small Business Accounting Services Featured in This Roundup:

Intuit QuickBooks Online Review

MSRP: $50.00

Pros: Excellent user interface and navigation. Flexible contact records and transaction forms. Customizable reports. Comprehensive payroll support. Hundreds of add-ons and integrations. New project-management support.

Cons: Expensive. Poor online documentation.

Bottom Line: QuickBooks is the best online accounting application for small businesses, thanks to its depth, flexibility, and extensibility. It's easy to use, well designed, and built to serve a wide variety of users, but it's also pricey.

Read ReviewFreshBooks Review

MSRP: $15.00

Pros: Freshbooks offers a delightful user experience that enable freelancers and SMBs to quickly invoice customers and get paid faster. Team collaboration tools, time tracking, and estimate functionality are great add ons.

Cons: Poor reporting functionality, limited features in the estimates tool. Late Fees feature could use more options.

Bottom Line: FreshBooks offers a well-rounded and intuitive time tracking, online accounting, and invoicing solution that anticipates the needs of freelancers and small businesses.

Read ReviewZoho Books Review

MSRP: $19.00

Pros: Affordable. Excellent user interface. Superior depth in records and transaction forms, including numerous custom fields. Multiple payment gateways. Good project- and time-tracking. Document management. Generous support options. Excellent mobile version.

Cons: Integrated payroll feature limited to California and Texas.

Bottom Line: Zoho Books is an excellent choice for cloud-based small business accounting, with an excellent interface, an attractive price, and a rich set of tools. Its limited payroll offering may cause some users to look elsewhere, however.

Read ReviewIntuit QuickBooks Self-Employed Review

MSRP: $10.00

Pros: Exceptional user interface and navigation. Easily tracks expenses and income. Automatic mileage tracking. Can assign business transactions to Schedule C categories. Estimates quarterly income taxes. OCR capability.

Cons: Lacks direct integration with e-commerce sites. No data records, time tracking, project tracking, or recurring transactions. Invoices not customizable or thorough. No estimates or sales tax.

Bottom Line: The simplicity of online accounting service QuickBooks Self-Employed may make it a good fit for some freelancers and independent contractors, but others will miss standard features like time tracking, project tracking, and estimates.

Read ReviewBilly Review

MSRP: $15.00

Pros: Excellent user experience and dashboard. Double-entry accounting. Easy to establish different sales taxes. Supports both quotes and estimates.

Cons: Some operations involve dealing with debits and credits. No timer or dedicated time-tracking. Few reports. No full mobile app. Only one third-party add-on.

Bottom Line: Billy's combination of tools and usability make it a good choice for freelancers and sole proprietors who need to track income and expenses and invoice customers. It doesn't offer a lot of reports or third-party add-ons, however.

Read ReviewGoDaddy Bookkeeping Review

MSRP: $3.99

Pros: Inexpensive. Good invoicing tools and overview. Simple time tracking. Calculates estimates for quarterly taxes. Direct integration with PayPal, Amazon, eBay, and Etsy.

Cons: No project tracking or bill payment. No individual logins for other users. Lacks multi-currency support. Minimal client information in records. No auto-categorization.

Bottom Line: GoDaddy Bookkeeping's direct integration with Amazon, eBay, and Etsy make it a terrific tool for entrepreneurs who sell at those sites, but its overall bookkeeping depth and flexibility doesn't match FreshBook's.

Read ReviewXero Review

MSRP: $30.00

Pros: Affordable. Thorough record and transaction forms. Approval levels. Inventory tracking. Customizable reports. Online quotes. Smart Lists. Updated expense tracking. Exceptional online support.

Cons: Payroll not available for all states. Time tracking still in beta. Lacks phone and chat help. Weak mobile apps.

Bottom Line: Double-entry accounting app Xero excels at inventory management, payroll, and many other functions critical to keeping the books of a small business.

Read ReviewWave Review

MSRP: $19.00

Pros: Free, though payments and payroll incur fees. Smart selection of features for very small businesses. Excellent invoice- and transaction-management. Good user interface and navigation tools. Multicurrency. Payroll.

Cons: No dedicated project- or time-tracking features. No comprehensive mobile app.

Bottom Line: Wave is priced like a freelancer accounting application (it's free) and it's an excellent service for that market, but it also offers enough extras that a small business with employees could use it-with some caveats.

Read ReviewKashoo Review

MSRP: $19.99

Pros: Simple, clean user interface. Good income and expense management. Project cost-tracking. Free email, phone, and chat support. Integrates with SurePayroll.

Cons: Doesn't use a standard dashboard. Lacks time and inventory tracking. No Android app. Few add-ons.

Bottom Line: Online accounting service Kashoo's strengths are income and expense management, usability, and support. It's a simple, speedy choice for smaller businesses that don't need product inventory tracking or robust time billing tools.

Read ReviewWorkingPoint Review

MSRP: $9.00

Pros: Customizable dashboard. Good user experience. Capable inventory tracking. Estimates quarterly taxes. Schedule C report. Includes simple company website.

Cons: No mobile version. Recurring invoices are dispatched without review. Inflexible user permissions. Few add-ons. No built-in payroll or integration with payroll services.

Bottom Line: WorkingPoint is an easy-to-use double-entry accounting service with unique features like quarterly estimated tax calculation and a mini site builder, but it has no mobile version or payroll feature.

Read Review

Best Small Business Accounting Services Featured in This Roundup:

Intuit QuickBooks Online Review

MSRP: $50.00Pros: Excellent user interface and navigation. Flexible contact records and transaction forms. Customizable reports. Comprehensive payroll support. Hundreds of add-ons and integrations. New project-management support.

Cons: Expensive. Poor online documentation.

Bottom Line: QuickBooks is the best online accounting application for small businesses, thanks to its depth, flexibility, and extensibility. It's easy to use, well designed, and built to serve a wide variety of users, but it's also pricey.

Read ReviewFreshBooks Review

MSRP: $15.00Pros: Freshbooks offers a delightful user experience that enable freelancers and SMBs to quickly invoice customers and get paid faster. Team collaboration tools, time tracking, and estimate functionality are great add ons.

Cons: Poor reporting functionality, limited features in the estimates tool. Late Fees feature could use more options.

Bottom Line: FreshBooks offers a well-rounded and intuitive time tracking, online accounting, and invoicing solution that anticipates the needs of freelancers and small businesses.

Read ReviewZoho Books Review

MSRP: $19.00Pros: Affordable. Excellent user interface. Superior depth in records and transaction forms, including numerous custom fields. Multiple payment gateways. Good project- and time-tracking. Document management. Generous support options. Excellent mobile version.

Cons: Integrated payroll feature limited to California and Texas.

Bottom Line: Zoho Books is an excellent choice for cloud-based small business accounting, with an excellent interface, an attractive price, and a rich set of tools. Its limited payroll offering may cause some users to look elsewhere, however.

Read ReviewIntuit QuickBooks Self-Employed Review

MSRP: $10.00Pros: Exceptional user interface and navigation. Easily tracks expenses and income. Automatic mileage tracking. Can assign business transactions to Schedule C categories. Estimates quarterly income taxes. OCR capability.

Cons: Lacks direct integration with e-commerce sites. No data records, time tracking, project tracking, or recurring transactions. Invoices not customizable or thorough. No estimates or sales tax.

Bottom Line: The simplicity of online accounting service QuickBooks Self-Employed may make it a good fit for some freelancers and independent contractors, but others will miss standard features like time tracking, project tracking, and estimates.

Read ReviewBilly Review

MSRP: $15.00Pros: Excellent user experience and dashboard. Double-entry accounting. Easy to establish different sales taxes. Supports both quotes and estimates.

Cons: Some operations involve dealing with debits and credits. No timer or dedicated time-tracking. Few reports. No full mobile app. Only one third-party add-on.

Bottom Line: Billy's combination of tools and usability make it a good choice for freelancers and sole proprietors who need to track income and expenses and invoice customers. It doesn't offer a lot of reports or third-party add-ons, however.

Read ReviewGoDaddy Bookkeeping Review

MSRP: $3.99Pros: Inexpensive. Good invoicing tools and overview. Simple time tracking. Calculates estimates for quarterly taxes. Direct integration with PayPal, Amazon, eBay, and Etsy.

Cons: No project tracking or bill payment. No individual logins for other users. Lacks multi-currency support. Minimal client information in records. No auto-categorization.

Bottom Line: GoDaddy Bookkeeping's direct integration with Amazon, eBay, and Etsy make it a terrific tool for entrepreneurs who sell at those sites, but its overall bookkeeping depth and flexibility doesn't match FreshBook's.

Read ReviewXero Review

MSRP: $30.00Pros: Affordable. Thorough record and transaction forms. Approval levels. Inventory tracking. Customizable reports. Online quotes. Smart Lists. Updated expense tracking. Exceptional online support.

Cons: Payroll not available for all states. Time tracking still in beta. Lacks phone and chat help. Weak mobile apps.

Bottom Line: Double-entry accounting app Xero excels at inventory management, payroll, and many other functions critical to keeping the books of a small business.

Read ReviewWave Review

MSRP: $19.00Pros: Free, though payments and payroll incur fees. Smart selection of features for very small businesses. Excellent invoice- and transaction-management. Good user interface and navigation tools. Multicurrency. Payroll.

Cons: No dedicated project- or time-tracking features. No comprehensive mobile app.

Bottom Line: Wave is priced like a freelancer accounting application (it's free) and it's an excellent service for that market, but it also offers enough extras that a small business with employees could use it-with some caveats.

Read ReviewKashoo Review

MSRP: $19.99Pros: Simple, clean user interface. Good income and expense management. Project cost-tracking. Free email, phone, and chat support. Integrates with SurePayroll.

Cons: Doesn't use a standard dashboard. Lacks time and inventory tracking. No Android app. Few add-ons.

Bottom Line: Online accounting service Kashoo's strengths are income and expense management, usability, and support. It's a simple, speedy choice for smaller businesses that don't need product inventory tracking or robust time billing tools.

Read ReviewWorkingPoint Review

MSRP: $9.00Pros: Customizable dashboard. Good user experience. Capable inventory tracking. Estimates quarterly taxes. Schedule C report. Includes simple company website.

Cons: No mobile version. Recurring invoices are dispatched without review. Inflexible user permissions. Few add-ons. No built-in payroll or integration with payroll services.

Bottom Line: WorkingPoint is an easy-to-use double-entry accounting service with unique features like quarterly estimated tax calculation and a mini site builder, but it has no mobile version or payroll feature.

Read Review